Having problems accessing your mortgage? Here comes the Italian state’s guarantee!

Having problems accessing your mortgage? Here comes the Italian state’s guarantee!

I am a great fan of the Revenue Agency guides because, in a changing context of regulation, they always explain the various topics in a clear and precise way.

This article is, in fact, drawn and inspired by the brochure “House? Conviene!” of September 2017, disclosed by the Revenue Agency. I translated it for you.

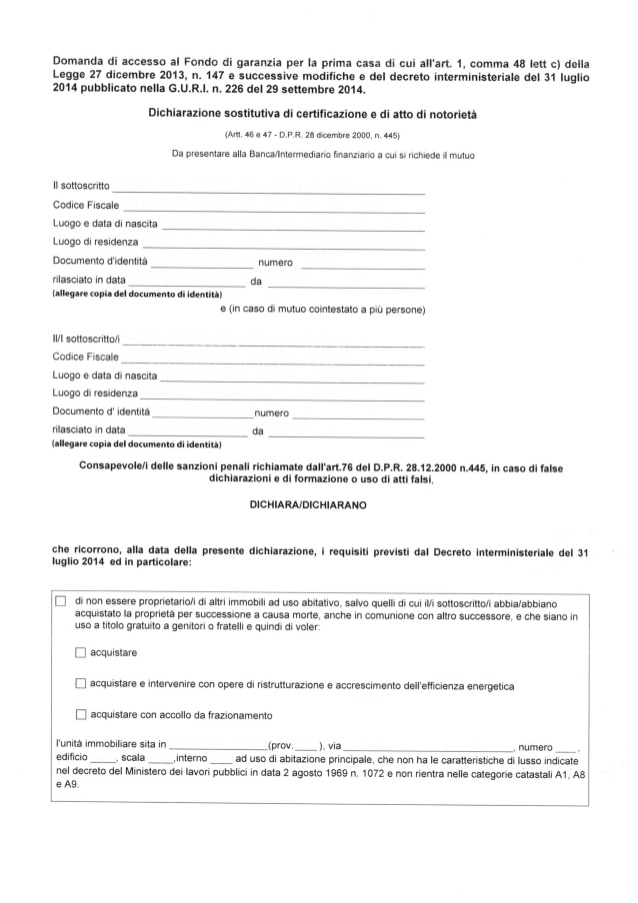

The Guarantee Fund for the purchase and renovation of the first home allows you to apply for mortgages up to € 250,000 using state guarantees for the half of the amount. You can find the normative references to Article 1, paragraph 48, Law no. 147 of 2013 and the Interministerial Decree of 31 July 2014.

To whom it is addressed

For those who require a mortgage for their first home, not more than 250,000 euros. The mortgage must be paid only for the purchase or purchase and restructuring and / or increase of the energy efficiency of a property located in Italy that respects the following characteristics:

- It must be used as a main dwelling;

It does not have to belong to the categories of the Italian land registry A1 (noble dwellings), A8 (villas) and A9 (castles, palaces);

It must not have luxury features (according to the Decree of the Ministry of Public Works of 2/8/1969).

What are the benefits

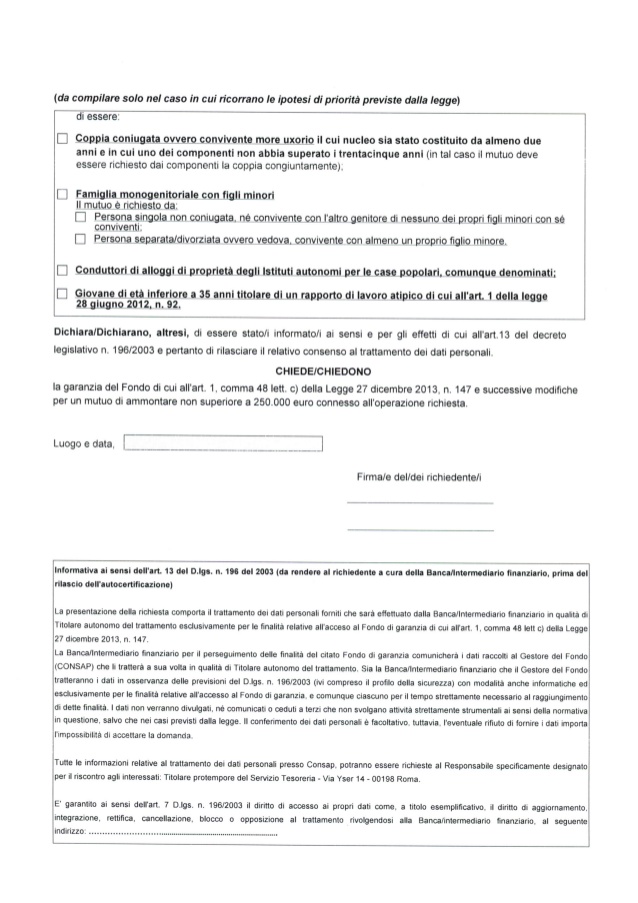

The Fund offers state guarantees equal to 50% of the capital of the mortgage required, thus facilitating access to credit. It is open to all, regardless of age, but provides for a rate applied to the mortgage not higher than the average global average rate (TEGM) published quarterly by the Ministry of Economy and Finance under the anti-wear law for:

- Young couples (where at least one of the two components did not exceed 35 years);

- Young people under the age of 35 who hold an atypical employment relationship;

- Single-parent family with underage children.

By accessing the Fund, the bank, guaranteed by the State, can not apply for additional personal guarantees (eg parental or relative guarantees) in addition to the mortgage and any insurance.

How do you get it

The application for access to the Fund must be submitted directly to the Bank to which the mortgage is asked.

If you need a facsimile to prepare the application for access to the fund you will be able to download this document.

For any information about the process of buying a house in Italy, write to info@ortalloggi.com, I will be happy to answer your questions.

Alice – www.ortalloggi.com

To find out more

To find out more, I have prepared for you a list of institutional websites where you will surely find the answers to your questions! The sites are in Italian only!